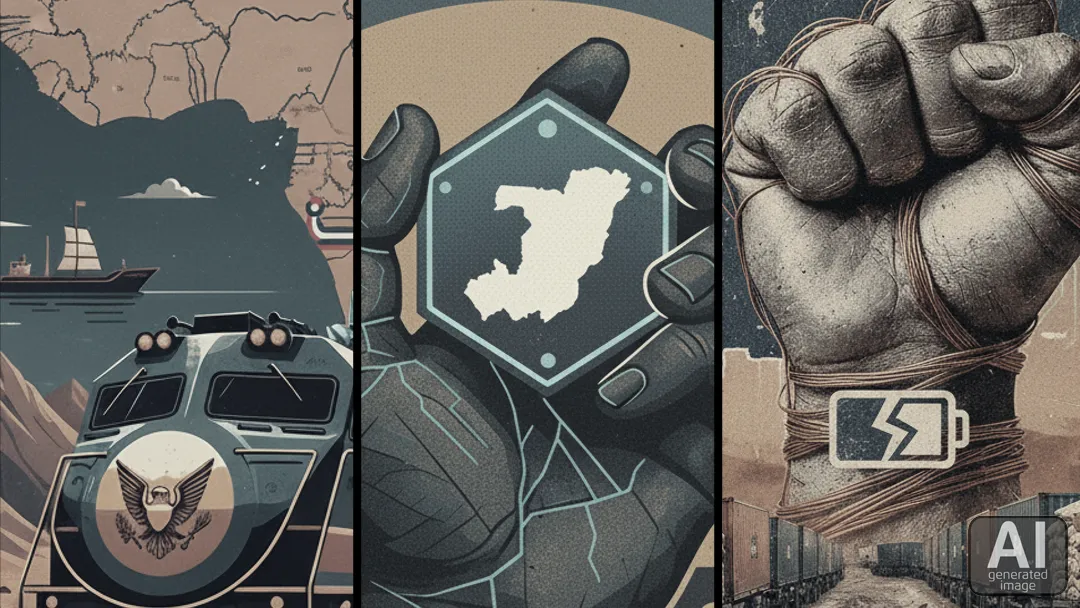

D.R. Congo’s Critical Minerals Sector Enters New Era Amid US Investment and Rising Regulatory Tensions

US investment, new cobalt rules, and industry pushback reshape Congo’s critical minerals sector amid shifting global supply chains.

The Democratic Republic of the Congo is entering a decisive period in the evolution of its critical minerals sector, marked by major geopolitical shifts, ambitious infrastructure investments, and rising regulatory complexity. Recent developments illustrate how Congo is repositioning itself within global supply chains for copper and cobalt, minerals that are central to defence technologies and clean energy systems. At the same time, new export rules have created uncertainty for producers and traders, prompting the mining lobby to call for urgent dialogue with the government to safeguard commercial stability and international confidence.

The United States has announced plans to deploy more than 1 billion dollars into new critical minerals projects and railway infrastructure in Congo, a move designed to secure long term access to strategic resources while reducing dependence on China controlled supply chains. This initiative includes financial backing from the US International Development Finance Corporation and complements a newly announced copper and cobalt trading partnership between Mercuria and Gecamines. Central to the strategy is the expansion of the Lobito Corridor, a rail network linking Congo and its neighbours to Angola’s Atlantic coast, which is expected to give Congolese mineral exports a western outlet with faster transit times and improved access to global markets. This reorientation demonstrates Congo’s growing alignment with US economic interests and highlights the country’s significant reserves of copper, cobalt, lithium, tantalum, and manganese.

Parallel to these geopolitical manoeuvres, Congo has introduced stringent new requirements for cobalt exporters, including a 10 percent royalty pre payment within 48 hours of filing export declarations, mandatory compliance certificates, and extensive multi agency approvals. The reforms are part of a shift from a months long export ban to a quota based system launched in October, which aims to strengthen revenue collection and improve oversight of mineral flows. Quota Verification Certificates issued by ARECOMS must now accompany all shipments, which will undergo physical inspection before departure. The uncertainty surrounding the implementation of these rules, particularly regarding valuation for the royalty payments and alignment with past shipments, has stalled cobalt exports despite the recent allocation of 18,125 tons for Q4 2025 and an annual quota of 96,600 tons beginning in 2026. These administrative bottlenecks come at a time when cobalt prices have risen sharply from earlier lows, increasing pressure on producers to resume shipments.

Against this backdrop, Congo’s mining lobby is pressing for immediate discussions with the government to address concerns over the legality, clarity, and practicality of the new export framework. The Chamber of Mines argues that ambiguous documentation requirements, unclear authority assigned to ARECOMS, and the legality of mandatory prepayments risk undermining the mining code and eroding investor confidence. Companies warn that continued delays could disrupt supply chains for electric vehicles and battery manufacturers, particularly since analysts expect China may not receive cobalt cargoes before April due to both administrative holdups and infrastructure constraints. The mining sector stresses that predictable regulation is essential for supporting long term investment and maintaining Congo’s global credibility as a critical minerals supplier.

Taken together, these developments suggest a complex but consequential period ahead for Congo’s mining industry and its role in Africa’s broader economic landscape. Increased US engagement and improved transport corridors could diversify export routes and stimulate regional integration, potentially reducing China’s dominance in critical mineral trade through Central Africa. However, the tightening of regulatory controls, if not clarified through constructive government industry dialogue, risks constraining production, disrupting global battery material supply chains, and weakening the investment climate. How Congo balances strategic partnerships, regulatory reform, and investor certainty will significantly influence the trajectory of both its domestic mining economy and Africa’s long term position in global energy transition markets.

Mini Glossary

- Critical minerals Minerals essential for high tech, defence, or clean energy applications.

- Lobito Corridor A rail and logistics route connecting Congo and neighbouring states to Angola’s Atlantic coast.

- Quota system A regulatory mechanism that limits the volume of mineral exports within a specified period.

- ARECOMS The Congolese agency responsible for issuing compliance and quota verification documents for mineral exports.

- Royalty pre payment An advance payment of government dues based on declared export values.

Editor: Vural Burç ÇAKIR